We previously outlined some of the key provisions of the American Rescue Plan (ARP) and how they will impact ACA enrollments, as well as key information and dates you need to know as an agent in order to assist your customers during the COVID-19 Special Enrollment Period.

In this article, we’ll go into more detail and discuss opportunities for two of the customer segments impacted by ARP’s expanded subsidies, middle-income earners over 400% FPL, including older enrollees in the 60-64 age range and young adults turning 26.

Other customer segments are discussed in detail in separate articles and include those:

Flattening the Subsidy “Cliff” for Middle-Income Earners

Prior to ARP, approximately 8 million people were priced out of ACA plans due to the subsidy cliff, according to Kaiser Family Foundation (KFF).[1]

What does it mean to climb the “subsidy cliff?” Because there was no subsidy phase-out, at 400% FPL a household simply stopped qualifying for assistance.

In one example, that meant that a senior making $50,000 per year could qualify for a subsidy at 392% FPL that lowered their premium to $410 per month but would suddenly be responsible for the full premium amount of $957 for the same plan if their income increased to $51,040 per year (putting them at 400% FPL).[2]

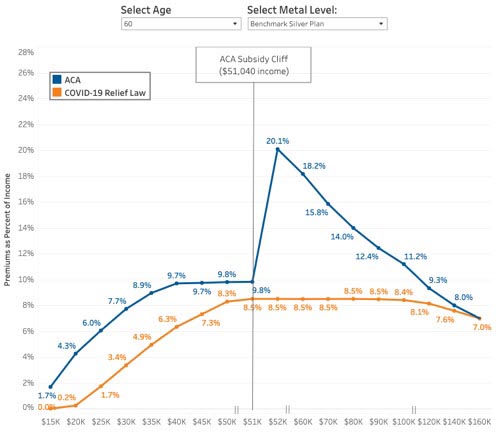

The graphic representation below from KFF[3] illustrates how capping subsidy eligibility at 400% FPL (the middle gray vertical line) resulted in a “cliff” prior to ARP (the blue line) compared to after ARP (the orange line).

The data points correlate to the premium as a percent of income. By expanding subsidy eligibility to those at and above 400% FPL, an individual is never paying more than 8.5% of their income in ACA premium.

Older ACA Enrollees Benefit the Most

For ACA plans, location, age, tobacco use, number of insureds, and plan category are the factors that determine premium rates.[4]

As such, a younger non-smoker in a state with lower healthcare costs will pay less than an older non-smoker in the same state, or a state with higher healthcare costs.

Flattening the subsidy cliff and expanding subsidies to those at and above 400% FPL has a much greater impact on older enrollees aged 60-64 as they stand to see some of the most significant savings due to ARP.

The three tables below compare national average monthly premiums across three plan categories for an enrollee at 430% FPL at age 60, 40, and 27.[5]

60-year old: National Average Monthly Premium Rate Change at 430% FPL[6]

| Premium Before ARP | Premium After ARP | Savings | |

| Lowest-Cost Bronze Plan | $634 | $146 | -$488 |

| Benchmark Silver Plan | $887 | $390 | -$497 |

| Lowest-Cost Gold Plan | $951 | $453 | -$498 |

40-year old: National Average Monthly Premium Rate Change at 430% FPL[7]

| Premium Before ARP | Premium After ARP | Savings | |

| Lowest-Cost Bronze Plan | $327 | $258 | -$69 |

| Benchmark Silver Plan | $449 | $380 | -$69 |

| Lowest-Cost Gold Plan | $481 | $412 | -$69 |

27-year old: National Average Monthly Premium Rate Change at 430% FPL[8]

| Premium Before ARP | Premium After ARP | Savings | |

| Lowest-Cost Bronze Plan | $272 | $248 | -$24 |

| Benchmark Silver Plan | $373 | $349 | -$24 |

| Lowest-Cost Gold Plan | $400 | $376 | -$24 |

Sample ACA Subsidy: 62-year old in 86001 zip code

As a point of reference, with ARP-adjusted subsidies, a 62-year old non-tobacco user in Arizona (86001 zip code) with an annual income of $57,000 (447% FPL) is eligible for a $404 per month Silver plan (with $907 in subsidies), or a $150 per month Bronze plan.[9]

Customers (or their Children) Turning 26 in 2021, 2022

Many young adults face economic uncertainty in the post-COVID economy. They may have experienced unemployment in 2020 or 2021 (possibly qualifying for a $0 premium Silver plan), and many may be working part-time, seasonally, or be part of the growing gig economy as contractors, meaning no access to benefits when they age off of a parent or family member’s employer-sponsored plan.

In fact, according to KFF, 39% of those eligible for a $0 premium Bronze plan as a result of ARP are between the ages of 19 and 34 (compared to 25% of the non-elderly population), and 47% are eligible for a partial subsidy (compared to 24% of the non-elderly population).[10]

Prior to ARP, a 27-year old making just $40,000 could have been responsible for paying 9.5% of their income towards their premium before they received a tax credit (or $316 per month).

With the ARP-adjusted and expanded subsidies, the percent of income paid as premium is capped at 8.5%, and that same 27-year old would only be responsible for paying 6.3% of their income or $211 monthly.[11]

Percent of Income Paid by Enrollee for Marketplace Benchmark Silver Premium (by income)[12]

| Enrollee’s Income as % FPL | Before ARP | After ARP |

| Under 100% FPL | 100% – Not subsidy-eligible | Not subsidy-eligible |

| 100 – 138% FPL | 2.07% | 0% |

| 138 – 150% FPL | 3.10 – 4.14% | 0% |

| 150 – 200% FPL | 4.14 – 6.52% | 0 – 2% |

| 200 – 250% FPL | 6.52 – 8.33% | 2 – 4% |

| 250 – 300% FPL | 8.33 – 9.83% | 4 – 6% |

| 300 – 400% FPL | 9.83% | 6 – 8.5% |

| Over 400% FPL | 100% – Not subsidy-eligible | 8.5% |

Sample ACA Subsidy: 26-year old in 86001 zip code

As a point of reference, with ARP-adjusted subsidies, a 26-year old non-tobacco user in Arizona (86001 zip code) with an annual income of $43,000 (337% FPL) is eligible for a $248 per month Silver plan (with $219 in subsidies), or a $157 per month Bronze plan.[13]

How to Help Customers at or over 400% FPL

Review the current health insurance plan selection and subsidy eligibility of both older (60-64) and younger (26+) customers as they may be eligible for the recently expanded and/or increased premium tax credits.

If you do nothing, your subsidy-eligible clients will receive their additional premium tax credit when they file their 2021 tax return next year. However, young adults tend to appreciate having more cash on hand, and those approaching retirement age may benefit from being able to invest more of their earnings throughout 2021.

In both instances, customers will benefit from ACA advance premium tax credits, which allows them to pay the subsidy-adjusted premium each month. And accessing them requires updating an existing ACA application if they have one or enrolling in a new ACA plan.

Luckily, during the COVID-19 Special Enrollment Period, you can do both.

What to do:

- Send your customers the INSXCloud digital Applicant Intake Form and ask them to validate and update any information so you can determine subsidy eligibility and plan options.

- You can also rerun existing customer data through the INSXCloud subsidy calculator to determine subsidy eligibility that way.

- Enroll customers in a new ACA plan on INSXCloud and optionally add ancillary benefits. Those at and above 400% FPL are less likely to qualify for additional cost-sharing reductions and may welcome supplemental Gap insurance coverage, especially if they’re seeing significant monthly savings on an ACA Bronze plan, as shown in the sample ACA subsidy for a 62-year old above.

Remember to inquire about adult children of your customers, changes to annual income and employment status over the past 12 months, and generally educate customers about the $0 premium Silver plan option for anyone who collected unemployment benefits in 2021 (even if they were laid off from a job that did not provide them health coverage).

Next Steps for Agents

Be proactive. Expanded subsidies are available to your customers now – make sure they don’t miss out on advance premium tax credits or affordable coverage options that are newly available to them as part of ARP.

Remember, INSXCloud helps you quickly and easily complete the necessary steps to determine subsidy eligibility and enroll qualifying customers in ACA plans in FFM states by providing:

- Built-in subsidy eligibility and affordability calculators.

- The “bridge” from IHC Producer Portal to INSXCloud, to quote any customers in INSXCloud who are in your IHC Producer portal without having to rekey data (and add ancillary coverage options too).

- A convenient digital Applicant Intake Form that allows you to collect (or update) all the customer information you need to apply for coverage on their behalf at HealthCare.gov (via INSXCloud).

- Access to unlimited customizable individual private exchanges that can be created for any group or customer segment to facilitate self-enrollment.

Not yet using INSXCloud? Don’t wait. It’s free (and quick) to sign-up when you contract with IHC Specialty Benefits.